Amazon Seller Forums are full of these kind of posts.

Does Amazon Collect and Pay Sales Tax GST for Sellers on Amazon Canada?

This is one of the most common questions we see from new amazon sellers. Do I have to pay sales taxes if I sell on Amazon Canada? Does amazon collect it and give it to me? Does amazon give it to the government for me?

As a seller it is very important that you understand how sales taxes work in Canada, your responsibilities to the Canada Revenue Agency and how to correctly set up the tax configurations in seller central.

In this article, we’ll look at if Amazon collects and pays sales tax for sellers on Amazon Canada, simplifying the sales tax into easy-to-understand terms. We’ll also show you a few example calculations to help you understand.

As we go through this, please understand, sales taxes are charges based on the shipping address of the order. The tax rate is not where you are located or where the goods are stored, or the billing address on a credit card for the order, but on the province that the order is actually shipped too.

Online Sellers Sales Taxes in Canada

In Canada, sales tax can be divided into three types:

Goods and Services Tax (GST): A federal tax applied to most goods and services .

Harmonized Sales Tax (HST): A combination of GST and provincial sales tax (PST) in some provinces. Provinces that decided to combine their PST with the federal government are referred to HST.

Provincial Sales Tax (PST): A tax applied by certain provinces, separate from the GST where some provinces decided to keep their provincial sales taxes separate. These include British Columbia, Saskatchewan, Quebec, and Manitoba.

Who is Responsible for Collecting Sales Tax?

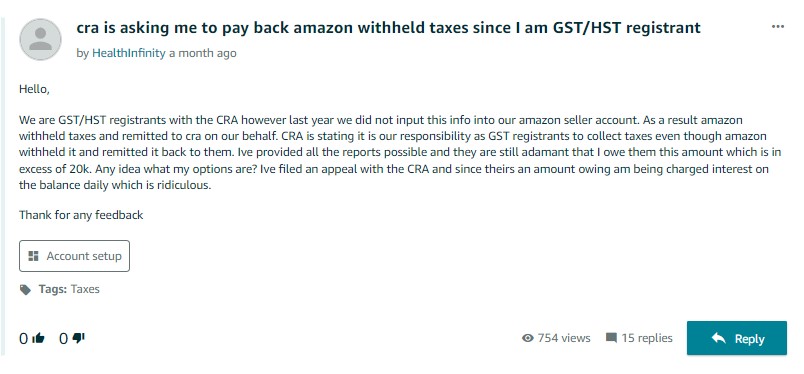

The Canada Revenue Agency says that in general, the seller is responsible for collecting sales tax on sales made through Amazon.ca. However, Amazon has a marketplace facilitator law that requires them to collect and remit sales tax on behalf of sellers for certain transactions. If you are not registered with CRA and have not updated the GST/HST number in seller central, amazon will collect and remit the sales taxes. But once you have registered then you should be the one responible.

How to Register for Sales Tax

If you have not registered and entered your GST/HST number in seller central then Amazon will collect and remit on your behalf. As the CRA outlines, once you hit $30,000 Canadian dollars in worldwide sales are are required to register for GST/HST. To register you can go to CRA website HERE.

When Does Amazon Collect Sales Tax for Sellers?

Amazon collects and remits sales tax on behalf of sellers for orders shipped to the following provinces:

– British Columbia (BC)

– Manitoba (MB)

– Quebec (QC)

– Saskatchewan (SK)

For these provinces, Amazon calculates, collects, and remits the appropriate sales tax amount on behalf of sellers unless you are registered. Now if you are registered for tax in those provinces based on your location, you should update your amazon settings so Amazon will collect and give you the funds to remit. BC however even if you are registered, Amazon will still remit on your behalf. For other provinces and territories, sellers must handle the sales tax themselves.

Example Calculation: Sale shipped to British Columbia

Let’s say you sell a toy for CAD 100 to a customer in British Columbia. The applicable sales tax rate (PST + GST) in BC is 12% (7% PST + 5% GST).

Calculation:

– Sale Price: CAD 100

– Sales Tax Rate: 12%

The sales tax collected would be:

CAD 100 * 12% = CAD 12

Amazon would collect the CAD 12 sales tax. If you register for GST/HST and updated it correctly in seller central, then Amazon would collect the entire $12, and include $5 in your disbursements to remit to the CRA for the GST portion. The PST portion they would remit to the BC government. If you do not have a GST/HST number in seller central, then Amazon would remit both, the $5 to the CRA and the $7 to the BC PST authority.

Example Calculation: Sales to Alberta

Now, consider a sale of a toothbrush for CAD 100 to a customer in Alberta. Alberta does not have a PST, only GST applies, which is 5%.

Calculation:

– Sale Price: CAD 100

– Sales Tax Rate: 5%

The sales tax collected would be:

CAD 100 * 5% = CAD 5

In this case, Amazon collects the GST for Alberta and will include in your disbursements so you will then pay the CRA. If there is no GST/HST number registered with amazon then they will remit the 5% to CRA.

Reporting and Remitting Sales Tax

As a seller, you’re responsible for reporting and remitting the sales tax you collect to the appropriate tax authorities. Here’s a simplified process:

- Calculate: Determine the total sales tax collected during the reporting period minus amounts paid since GST/HST is a recoverable tax.

- File: Submit your sales tax return to the CRA and/or provincial tax authorities.

- Pay: Remit the collected sales tax. These amounts should be included in your disbursements.

Be careful when you are calculating the amounts to remit that you don’t incorrectly pay NARF shipments and PST that was remitted. This is a costly mistake and amazon reports are not necessarily easy to follow. Another costly mistake is paying PST amounts as GST/HST amounts when Amazon is paying those. No need to double pay sales taxes!

Conclusion

Sales tax collection in Canada can get messy if you have not set up the taxes correctly and can be a costly mistake. We have seen it time and time again with sellers trying to do it on their own, not setting up skus correctly and getting into a big CRA Audit. If you want us to help you take care of it, please reach out!