Amazon.com will not pay US dollars into a Canadian based account.

Yes that means even if it is a US dollar account, based in a Canadian bank, amazon will not pay into it. The result is they will convert the US dollars into Canadian at a less than great exchange rate and then just give you Canadian dollars. This is a huge problem for sellers who need US dollars to pay vendors, US credit cards never mind losing the foreign exchange rate. Every time your cash is converted I guarantee someone is making margin on the foreign exchange rate and your profits are slowly slipping away.

So here are the issues we need to solve.

#1. How do I actually get the US dollars paid from Amazon.com?

#2. How to get a good exchange rate?

Option #1

Here is my solution: OFX.com

OFX.com will open up a US bank account to pay your amazon.com payments into. Basically, it’s a virtual account using their accounts with Bank of America that are actually in America! The deposits will go into their account on your behalf. Then you can log into your dashboard and move the money around.

This solution is good because:

- Get the US dollars out of amazon.com

- Better Foreign Exchange Rates than the Banks (yes they make money on your FX)

- Pay overseas Vendors and not have to go to Western Union with a stack of cash

- Canadian and US based staff who pick up the phone and talk to you!

That’s right. These guys have people in Toronto, US and around the world who actually pick up the phone and explain how they work, get you set up and answer any questions you have.

My personal contact is Amelie Deschenes and she rocks! Give her a call or email and tell her I sent you and ask her to walk you through what a Canadian Amazon sellers needs. She is well aware of the unique requirements of Canadians selling on amazon.com and moving money around.

You can then move money back to your US dollar Canadian based account, pay overseas vendors or convert the US dollars to Canadian dollars at an exchange rate way better than any bank or amazon is going to give you.

Lets Save Money!

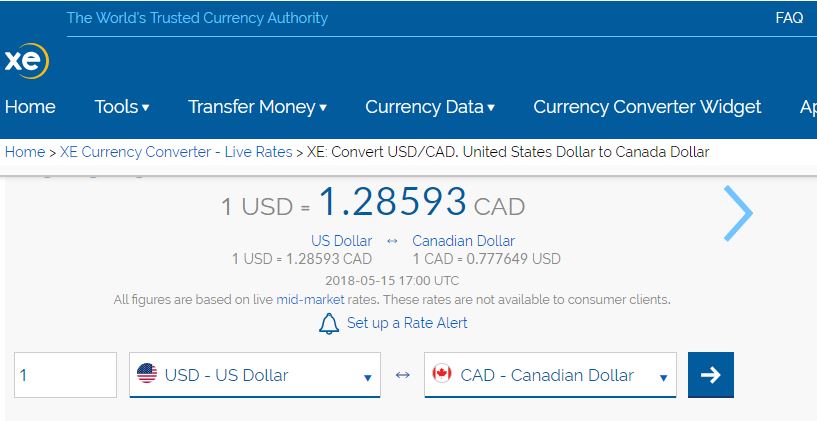

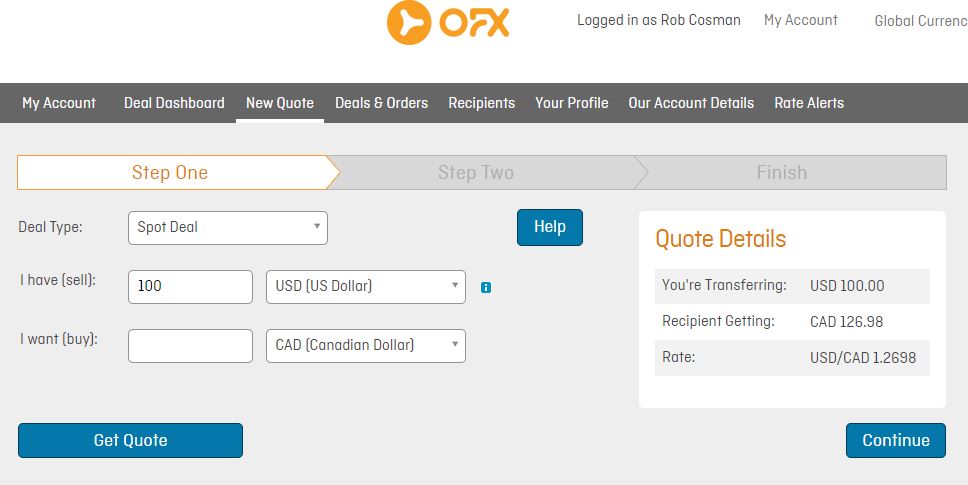

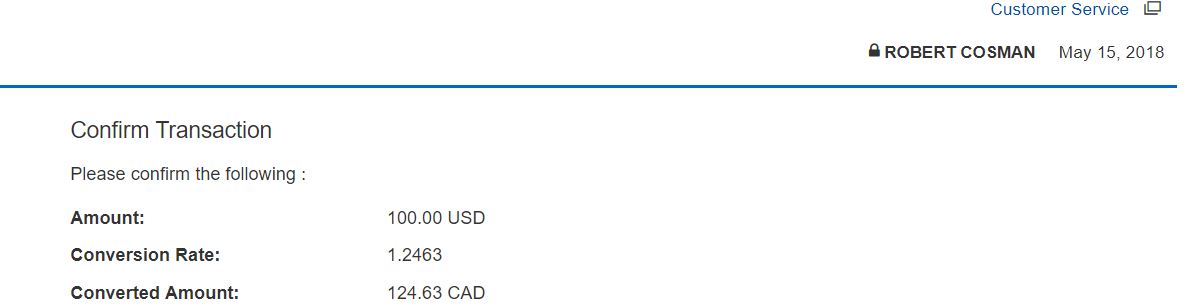

Quick Example: I just pulled these exchange rates on May 15, 2018. The spot rate is the current foreign exchange rate the CAD and USD are trading at. You will never get that, however, it is the benchmark we will look at. I logged into my RBC and OFX accounts to compare the rates on a small transfer of $100 and compare the rates. Now on OFX if you move larger amounts you will get a slightly better rate, but this works for comparison purposes.

As you can see the differences doesn’t look like a lot at 2.35%, however as your numbers get larger the difference can be significant! In this business every percentage counts and keeping your foreign exchange is key.

| 15-May-18 | Difference From Spot | On $1,000 | On $10,000 | On $50,0000 | |

| FX Spot Rate | 1.28593 | ||||

| OFX.com | 1.2698 | 0.01613 | $ 16.13 | $ 161.30 | $ 806.50 |

| RBC | 1.2463 | 0.03963 | $ 39.63 | $ 396.30 | $ 1,981.50 |

| OFX Savings vs RBC | $ 23.50 | $ 235.00 | $ 1,175.00 | ||

| % Savings | 2.35% | 2.35% | 2.35% |

Let us add in some screen grabs for additional creditability :)

Option #2

US Based Banks

There are a number of cross-border US based account options that can also work and you can generally set up from Canada.

Royal Bank – RBC Georgia

This is a “US Based” RBC Bank, commonly known as RBC Georgia. I think their main marketing is to “snowbirds” who have US bills to pay, maybe rent out their places a bit. They do say expats working in the states. It is fairly easy to set up from Canada, online or going into a local RBC branch. You can usually get a US based credit card as well. The risk is these are “personal” accounts. Lots of sellers will try to use these accounts, however expect that if you continue to get payments on a frequent basis and/or a good chunk of cash they will flag you and give you a call…..”sorry these are for personal, if you are using for a business, we need to move you to a business account”. And those run about $150 a month!

Personal Account. https://www.rbcbank.com/cross-border/us-bank-accounts.html

Corporate Account https://www.rbcbank.com/cross-border/business-banking.html

BMO Harris

Another good US based Option. Their small business account options have pretty low monthly maintenance fees.

Personal Account https://www.bmoharris.com/main/personal/checking-accounts/

Small Business Account https://www.bmoharris.com/main/small-business-banking/

TD Bank

Depending on your home bank, some of these can easily move from the US based to the Canadian based accounts very easily.

The biggest downside is converting the US dollars into Canadian. As you can expect banks like to make money so they make it converting your US dollars into Canadian. I use to go into my RBC branch and ask them for a preferred exchange rate and they would give me a preferred staff rate, that would save a little bit.

Option #3 Let Amazon Do It

Yep, you can just have amazon deposit your US dollars into your Canadian dollar account, but you will probably lose about 3-5%.

I would suggest if you are just starting out and not 100% sure this business is for you, keep it simple, and maybe just let amazon pay you.

If you are serious and know this business is for you, do it correctly now, get set up correctly from the start. Get a banking solution that will work as you grow and expand to other global markets, not just .com. My choice is setting up an OFX account and using a Canadian based USD and CAD accounts.

Do you really want to do this all over again to set up in say the UK? I don’t think so……

Make sure you join our facebook group:

https://www.facebook.com/groups/637461813299364

[/vc_column_text][/vc_column][/vc_row]