As a Canadian Amazon Seller, and your year end comes to a close, one of the most important things you will need to do is calculate your ending inventory for tax purposes. This applies to both sole proprietors and corporations. If you are wondering how to calculate year end inventory in Amazon, this is the article for you.

First, let’s review and make sure we understand Inventory vs Cost of Goods Sold. Inventory is the items you have that are not sold, so they are assets to the company and on the balance sheet. When inventory is actually sold, then it is moved to the income statement as cost of good sold. Buying more inventory at year end does not lower your profit and taxes. Only when it is sold.

The formula for Cost of Goods Sold = Opening Inventory + Purchases – Ending Inventory

Example: You start with $0 inventory. You buy $1,000 worth of product and you end the year with $200 cost of inventory. Your Cost of Goods Sold will be $800 ($0+$1,000-$200). The next year say you buy $2,000 and end the year with $100 in inventory. Your Cost of Good Sold would be $200 + $2,000 – $100 = $2,100.

It is common that sellers will record all purchases as either inventory or cost of goods sold during the year and then adjust to actual at year end but now you need to calculate that figure.

How to Calculate Your Ending Inventory

There are a few parts you need to add up to get your ending inventory number correct.

- Any inventory you have at your house or at a 3rd party warehouse or other location(s).

- Any inventory you have paid for and is on the way to you(in transit).

- Inventory held at amazon.

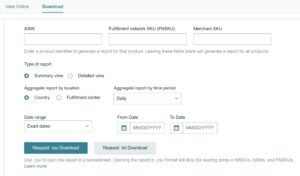

Finding the Right Amazon Year End Inventory Report

In 2023, Amazon has eliminated some of the old reports and is now using what they call the Inventory Ledger. Since they are eliminating daily inventory reports, we will use this report for this year and going forward.

To find this report in Seller Central, go to Reports > Fulfilment. It should be the first one under Inventory called Inventory Ledger.

You can select how you want to view the data, however I would suggest pulling the report with the following settings:

Summary View > Country Location > Daily Report, and select the exact date of your year-end, and download it in CSV file.

That should give you a report of your inventory, by sku, by country. You will need to wait to run this report a day or two after the ending date.

In this report, you would want to use the “Ending Warehouse” quantities plus also the “In transit Between Warehouse” and total them up. The ending warehouse total doesn’t seem to include the in-transit number so to correctly total your ending inventory that is with Amazon, you would want to include them as well.

Each item then you would value at the lower of your cost (what you paid for it) or market value. If you have an item that you think you can’t sell it for what you paid for it, you can value it at a lower amount.

Example: You paid $50 for an item but you think you could only sell it now for $20, then you would value that one for $20.

Any items that are Defective, Warehouse Damaged, Customer Damaged or any Disposition other than “Sellable”, I would value at either zero or what you think you could sell it for.

Valuing items lower like this will increase your Cost of Goods Sold and lower your profit for the year.

Once you have all these totals, you can then calculate your ending inventory.

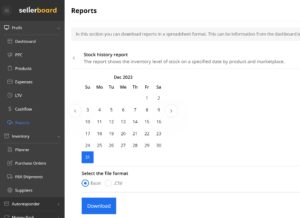

Sellerboard Ending Inventory

If you are a Sellerboard user, they have an even better ending inventory report. If you go under profit, reports, and then Stock History Report. Select the year-end date and then download the report. If you have the data correctly, it will show you the units and value. Simply just multiply them together to get the inventory value. Same as above you can adjust for damages or market value.

Don’t Forget to Calculate GST Return for Amazon Sellers

As part of your year-end, if you need help preparing your GST Returns, check out our how-to course for GST/HST Returns for Amazon Sellers here.